Press Release

|January 08,2025PropNex Budget Wishlist 2025: Review ABSD Rate For CCR Home Purchase; Raise MSR For New EC Purchase; And Harmonise ABSD Remission Treatment For HDB Upgraders Buying A Private Home

Share this article:

8 January 2025, Singapore - In the past three years, the Singapore private residential property market has seen a moderation in overall private home prices and more measured developers' sales, as various rounds of property cooling measures continue to bite.

Based on flash estimates, private home prices rose by 3.9% in 2024 - reflecting a multi-year trend of slowing price growth, following the price increase of 6.8% in 2023, 8.6% in 2022, and 10.6% in 2021. Meanwhile, new home sales moderated from 13,027 units (ex. EC) in 2021 to 7,099 units in 2022, and 6,421 units in 2023, which was a 15-year low. In 2024, developers' sales remain relatively measured at an estimated 6,525 units (ex EC) (till 29 Dec). Amid limited new launches, the private resale residential property segment held up, with an estimated 13,656 homes being resold (till 31 Dec), up from 11,329 units transacted in 2023; however, it is still substantially lower than the 19,962 private homes resold in 2021.

In particular, sales in the Core Central Region (CCR) have taken a hit since the tightening of the additional buyer's stamp duty (ABSD) measure in April 2023 - the fourth hike since the ABSD was introduced in December 2011. The doubling of the ABSD rate for foreigners (non-PR) purchasing a residential property in Singapore from 30% to 60% was especially hard hitting on the high-end homes segment in the CCR.

Ismail Gafoor, CEO of PropNex, said, "First off, we are supportive of the government's efforts in maintaining a stable housing market, where prices move in a more sustainable manner, in tandem with economic growth and income levels. We believe housing affordability, financial prudence, and taking a long-term view to property purchase are all key considerations when it comes to real estate transactions. That said, we think there is scope for the tweaking of the ABSD and certain housing policies to minimise any distortion in the market, as well as to ensure that there is no unintended negative impact on the interest of genuine home buyers - be it first-timers, or those looking at upgrading or right-sizing to a private home.

"Generally, cooling measures and government policies will influence consumer behaviour and potentially skew choices, thereby shaping the property market and households' housing aspirations. Our wishlist for Budget 2025 focuses on mitigating the disproportionate impact of the ABSD on the CCR market, and recommendations to help genuine home owners/buyers purchase a private home," Mr Gafoor added.

PropNex's recommendations

Recalibrate ABSD rate for foreigners buying a residential property priced above $5 million in the Core Central Region (CCR)

PropNex believes there is some room to adjust the ABSD rate for foreigners, particularly in the CCR where many homes may come with a much larger price tag, and may not necessarily be on the radar of Singaporean buyers. Perhaps the government can consider halving the ABSD rate for foreigners from 60% to 30% specifically for residential property purchase priced at $5 million or above in the CCR, which may not negatively impact the local demand pool.

The ABSD hike in April 2023 has had a bigger impact on the CCR market compared with the Rest of Central Region (RCR) and the Outside Central Region (OCR), as the CCR - often seen as a proxy for luxury, high-end homes - tends to see more interest from foreign buyers who are non-permanent residents of Singapore.

In 2024, CCR private home sales have been muted amid limited number of project-launches during the year. Notably, non-landed new and resale private home transactions in the CCR fell by 20% to an estimated 2,622 units in 2024 (till 31 Dec) from 3,272 units in the previous year. In contrast, that of OCR jumped by 32% in 2024 from 2023 to 9,272 units (ex. EC), while RCR private non-landed home sales rose by 4% to 6,434 units over the same period (see Table 1).

Table 1: Non-landed new and resale private homes sold (ex. EC) by region in 2023 and 2024*

Number of units | CCR | RCR | OCR |

2023 | 3,272 | 6,169 | 7,036 |

2024* | 2,622 | 6,434 | 9,272 |

YOY % change | -20% | 4% | 32% |

Meanwhile, non-landed private home prices in the CCR also rose at a slower pace, following the ABSD hike in April 2023. Between Q2 2023 and Q4 2024 (flash estimates), non-landed private home prices in the CCR grew by a cumulative 5.5% - lower than 7.6% in the RCR and 14.5% in the OCR.

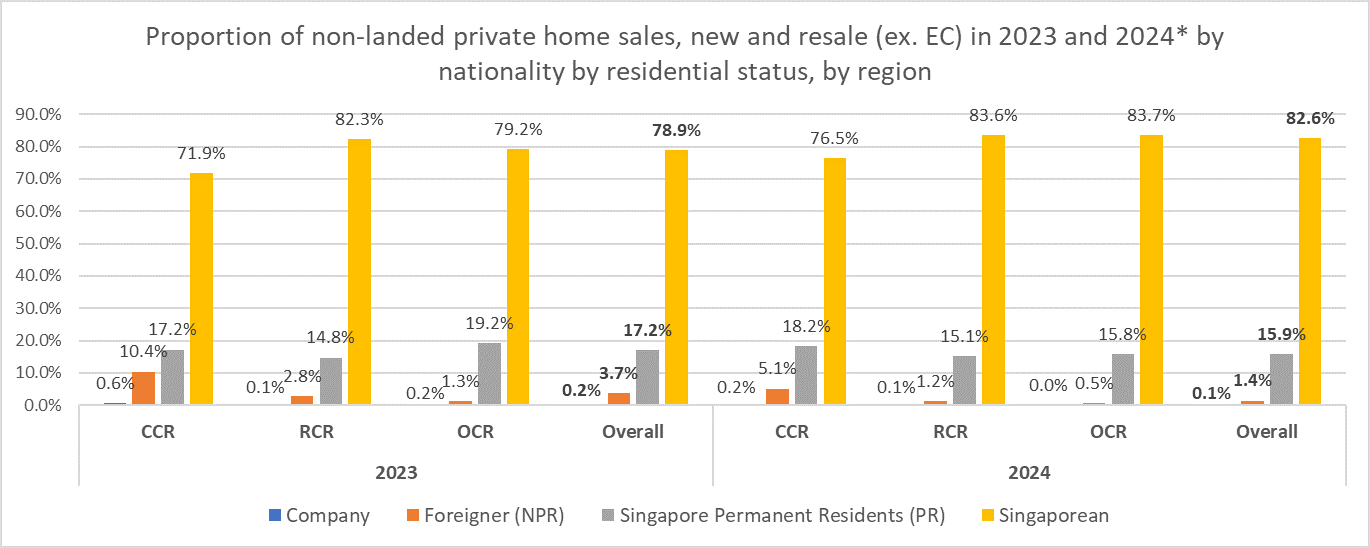

According to the URA Realis caveat data, foreign buyers (non-PR) made up 5.1% of non-landed private new and resale home transactions (ex. EC) in the CCR in 2024 (till 31 Dec), down from 10.4% in 2023 (see Chart 1). The proportion of foreign buyers has also fallen in the RCR and OCR to 1.2% and 0.5% respectively in 2024. Overall, foreigners (NPR) accounted for 1.4% of the non-landed new and resale private homes sold in 2024 - easing from the 3.7% proportion in 2023.

Chart 1: Proportion of non-landed new and resale private homes sold (ex. EC) by nationality by residential status, by region in 2023 and 2024*

By and large, the majority of Singaporean buyers tend to buy non-landed private homes priced below $5 million. In 2024 (till 31 Dec), 98% (or 17,973 out of 18,326 transactions) of the total new and resale non-landed private home sales (ex. EC) were priced at under $5 million, with Singaporean accounting for 83% of the transactions below $5 million, according to caveats lodged.

By region, an overwhelming number of non-landed private home transactions (ex. EC) in 2024 were to Singaporean buyers, who mostly bought homes priced at below $5 million - with 1,868 transactions in the CCR, 5,324 transactions in the RCR, and 7,753 transactions in the OCR (see Table 2).

Similarly, among the foreign buyers (NPR), there were more transactions priced at below $5 million in the three sub-markets (see Table 2). Based on market observations, few foreigners are willing to stump up the 60% ABSD payment, especially for big-ticket purchases.

Table 2: Number of caveats for non-landed new and resale private homes sold (ex. EC) by nationality by residential status, by region, by price range in 2024*

CCR | Company | Foreigner (NPR) | Singapore PR | Singaporean |

Below $5 million | 2 | 101 | 384 | 1,868 |

$5 million and above | 2 | 33 | 94 | 136 |

RCR | Company | Foreigner (NPR) | Singapore PR | Singaporean |

Below $5 million | 7 | 75 | 944 | 5,324 |

$5 million and above | 1 | 4 | 27 | 52 |

OCR | Company | Foreigner (NPR) | Singapore PR | Singaporean |

Below $5 million | 2 | 50 | 1463 | 7,753 |

$5 million and above | 0 | 0 | 0 | 4 |

Raise the mortgage servicing ratio (MSR) from 30% to 40% for buyers purchasing new executive condos (EC) from developers

The MSR refers to the portion of a borrower's gross monthly income that goes towards repaying all property loans. The MSR is capped at 30% of a borrower's gross monthly income and only applies to home loans for the purchase of an HDB flat or an EC (where the minimum occupation period of the EC has not expired).

It is a measure aimed at ensuring that buyers are prudent in their property purchase, and do not overstretch themselves. The MSR was first set at 40% during its inception, and it was eventually brought down to 30% in 2013 for housing loans granted to HDB flat and new EC buyers.

In view of the rising prices of new ECs, PropNex believes the 30% MSR for EC is due for a review. From 2013 to 2024 (till 25 Dec), the average unit price of new ECs has doubled from $758 psf to $1,531 psf (see Table 3), but in spite of the price increase, the 30% MSR has remained unchanged. Meanwhile, the monthly household income ceiling for new EC purchase was raised from $14,000 to $16,000 in September 2019, representing a 14% increase. However, the average unit price of new EC has jumped by 40% (from $1,093 psf to $1,531 psf) in 2024 from 2019.

Perhaps the government can retain the 30% MSR for HDB flats, but raise the MSR for new EC purchase to 40% to account for the higher EC prices. Generally, the prices of new EC units are significantly higher than that of new build-to-order (BTO) HDB flats and resale HDB flats. Hence, the MSR could be adjusted accordingly to be more aligned with the difference in prices between new EC units and public housing flats.

Based on HDB resale transaction data and caveats lodged, the average unit price of HDB resale flats in 2024 (till 31 Dec) was $603 psf, much lower than that of new EC at $1,531 psf (see Table 3). In terms of transaction prices, new EC units were averaging at around $1.6 million, while the average resale HDB flat price came in at just over $612,000 in 2024.

Table 3: Average unit price ($PSF) and average transacted price of new EC units and HDB resale flats by year

| New EC | HDB Resale | ||

Average of unit price ($PSF) | Average transacted price ($) | Average of unit price ($PSF) | Average resale price ($) | |

2013 | $758 | $910,713 | $469 | $476,441 |

2014 | $796 | $960,271 | $441 | $442,716 |

2015 | $799 | $910,472 | $423 | $434,710 |

2016 | $782 | $860,069 | $424 | $438,839 |

2017 | $798 | $815,050 | $425 | $443,889 |

2018 | $916 | $975,616 | $419 | $441,282 |

2019 | $1,093 | $1,194,719 | $416 | $432,138 |

2020 | $1,113 | $1,142,519 | $434 | $452,279 |

2021 | $1,176 | $1,264,358 | $488 | $511,381 |

2022 | $1,329 | $1,440,027 | $532 | $549,714 |

2023 | $1,406 | $1,561,534 | $564 | $571,804 |

2024 | $1,531 | $1,600,781 | $603 | $612,479 |

Table 4: Illustration on EC purchase financing at MSR rates of 30% and 40%

MSR 30% | MSR 40% | |

Median EC transacted price in 2024* | $1,502,000 | $1,502,000 |

20% down-payment^ | $300,400 | $300,400 |

Max loan amount** | $909,000 | $1,200,000 |

Balance/shortfall | $292,600 | $1,600 |

Monthly loan repayment | $4,798 | $6,334 |

Monthly mortgage cap under MSR | $4,800 | $6,400 |

As an illustration, a couple who has a monthly household income of $16,000 could get a maximum loan amount of $909,000 at an MSR of 30%. Bumping up the MSR to 40% will allow them to borrow $1.2 million (see Table 4), holding loan terms and their income constant. It can be observed that the higher bank loan amount will translate to less cash needed to cover the balance shortfall, at $1,600 with 40% MSR compared with $292,600 when MSR is at 30%, based on a median transacted price of $1,502,000 for new EC units in 2024 (till 25 Dec).

Adjusting the MSR will thus help to improve the affordability of new EC units, particularly for first-timer buyers who may not have as much personal savings or financial support from family members. Admittedly, this will mean that buyers will see an increase in their debt obligation, with higher monthly loan repayments.

Consider same ABSD stamp duty treatment for HDB upgraders buying private homes with that of new Executive Condo buyers

Presently, married couples who upgrade/right-size from an HDB flat to a private home will have to pay the ABSD upfront, within 14 days of signing the Sales and Purchase Agreement. They can apply for an ABSD remission if they sell their HDB flat within six months after the date of purchase or temporary occupation permit (TOP) or certificate of statutory completion (CSC), whichever is applicable.

This upfront ABSD payment is a hurdle for many families who wish to upgrade or right-size from their HDB flat to a private home, and it is now even more onerous with the tightening of the ABSD measure in April 2023 - which saw the ABSD rate for Singapore Citizens buying a second residential property jump from 17% to 20%. This represents a sizable upfront ABSD payment (e.g. the ABSD for a $1.4-million property is $280,000) and it leaves many households with little option but to sell their HDB flat first before purchasing a private home, so as to avoid the hefty upfront payment. Meanwhile, these households may incur unnecessary rental expenses when they lease a home in the interim as they search for a replacement home, and it may also be disruptive to their daily lives.

PropNex hopes that the government can consider harmonising the ABSD remission treatment for flat owners wishing to upgrade to a private home, with that of those looking to purchase new ECs from developers. Currently, HDB upgraders buying a new EC unit do not need to fork out the large ABSD payment upfront, they could also live in their existing flat and are required to sell their flat six months after their new EC receives TOP.

This will help HDB flat owners who wish to upgrade or right-size their housing, particularly families whose household income has exceeded the $16,000 monthly household income ceiling for new EC purchase, and have to turn to the private residential market for options. The government can make such buyers undertake a mandatory requirement to sell their HDB flat within six months from taking possession of their private home, and failure to do so would then result in the ABSD payment, plus a penalty fee for not adhering to the requirement.